- The Castle Chronicle

- Posts

- A Peek at Castle's Top Trends and Narratives for 2024

A Peek at Castle's Top Trends and Narratives for 2024

The Castle Chronicle: Volume 49

Within the Castle, there are a few Wizards with magical powers.

Read on to find out what they have seen in their Crystal Ball for 2024🔮

👀 What’s to Come in Volume 49

🔑 Key News: Coinbase in France, Revolut pause UK crypto buying, Epic Games allows blockchain games, Exploits, New Projects & more from CJ

📉 HTF Price Action Scenarios from Vlad

🔮 2024 Outlook Glance: Modular vs Monolithic, UX-focus, PMF and Perps, New Outlier Categories, AI and more! from Francesco and Atomist

⚔️ A Call to Arms

Think you have what it takes to enter the Castle and contribute to funding and advising projects across the space?

🔑 Key News

Major Headlines

Revolut to pause crypto buying for UK business customers

BVI court freezes Three Arrows Capital founders’ $1 billion in assets

Bitfinex Securities announces first tokenized bond on Liquid Network

Nigerian central bank lifts ban on crypto trading

Epic Games Store Changes Policies to Allow Blockchain Games in Its Platform Again

Project Updates

Ledger users lost $600k due to blind signing and will remove it next year

Kyberswap treasury grant program details announced for victims

Curve Finance vote executed to reimburse victims

Manta Network adopts Celestias DA layer

Friendtech teases v2 next year while Jupiter confirms airdrop in January

Binance introduces NFPrompt on their Launchpool

Frame announced their airdrop while Frax Finance teases a points/airdrop system

Pancakeswap proposal to reduce total supply of CAKE

Eigenlayer introduces Restaked Rollups

Render implements Burn Mint Equilibrium

Solana Saga phone orders canceled following 'inventory management' issue

Interesting Projects

Ethos: Restaking on Cosmos

Harvey AI: Legal AI which raised $80M in their Series B round

Suilend: Solend team expanding to Sui Network

Omnicat: Omnichain memecoin bridgeable via Stargate

Coconut Chicken: Memecoin on TRX with Justin Sun’s backing

Kryptonite: Liquid staking protocol on Sei

Courtesy of CJ - check out his telegram channel for daily news, project updates and new releases

📈 HTF Price Action Scenarios

Gm frens!

Last week we anticipated a re-accumulation. The market has since transitioned into a consolidation/sideways price action. Even though I am generally bullish, I will wait for a clear indication that the uptrend wants to continue.

Right now we see both sides of the range getting liquidated which is a clear sign of weak-to-strong hands transfer (money changing hands, composite man accumulating or distributing). There are no directional clues right now, except for the underlying bullishness of the HTFs.

Sideways price action/consolidation

Both range extremes are being liquidated

No clear directional clues

I will therefore wait for this most recently formed supply to get cleared before looking for longs again. Patience frens! Outperform the rest of the market by knowing when to stay out.

Trade responsibly and I’ll see y’all next week!

🔮 10 Trends and Narratives for 2024

As the year nears its end, the Castle reflects on our outlook for 2024, and the main narrative driving it.

This is a precursor of our full report - coming in the first days of 2024.

Without further ado, let’s dive into them, in no particular order.

1️⃣ Tech Developments: Modular vs. Monolithic

Rise of $SOL & Company vs. $ETH Improvements on the horizon.

2024 will mark the year when new primitives will launch their mainnet, from LayerZero to EigenLayer, Scroll, and more Data Availability solutions.

From an Ethereum-centric ecosystem to the emergence of new powerhouses, this category includes:

DA Solutions: Celestia, NEAR protocol

Zk Real World Applications: Taiko, Scroll

Restaking: EigenLayer has recently reached over $1b in assets locked on their platform, and could become the most valuable airdrop ever (Arbitrum currently has the n.1 spot with $1.5b).

LayerZero: airdrop and mainnet launch in 2024.

Berachain: The Most Mysterious L1 is set to release somewhere in 2024

We already see the “Bera Effect” on many NFTs related to Berachain, as airdrop speculation picks up (read Ericonomic threads on it).

Ethereum Roadmap: Focus on the main EIP Scheduled for 2024

ERC-4337 > EIP-4844 > EIP-3074 > EIP-5003

Infrastructural decentralization of rollups: rollups roadmap moving forward, with Stage 2 rollups

2️⃣ UX Improvements

As the DeFi landscape evolves, the tools that accompany the user journey don’t always keep up with it.

We envision 2024 to be a year where many developments will be focused on improving the crypto UX, from Intents to Account Abstraction wallets and more.

Evolution of Wallets: from trading bots to trading terminals (sophistication of traders, even playing field)

From Unibot > to Thunder Terminal

Account Abstraction: Creso Wallet $CRE, Avocado Wallet

Universal Profiles and On-chain Identity: Lukso, ERC-725

Intents: awareness and efficiency improvements in both perps and spot: IntentX, SYMMIO, and CoWswap.

Mobile-first apps, such as Friendtech but with greater security.

Institutions and DeFi: tools like Brahma, improving the use and flows of multi-sigs such as Safe.

Liquidity Fragmentation: Chainlink CCIP, Wormhole, LayerZero

Alternative Virtual Machines: The security considerations in conjunction with the performance limitations of the EVM raise concerns about their future.

We've seen considerable steps taken to elevate VMs to their next stage, of which the most notable was MoveVM.

Furthermore, Solana is gaining traction as an alternative L1 to Ethereum, with the adoption of the SVM execution layer to be enhanced by solutions like Eclipse, building an Ethereum-based SVM rollup, or Fuel Network with its custom VM, using Rust.

Another factor to take into account is the emergence of VM-agnostic solutions, enabling developers to deploy their customizable execution layers through services like Rollups-as-a-Service or comprehensive technological stacks such as Optimism’s Bedrock or Arbitrum Orbit.

3️⃣ Regulation

We find this mentioned every year, hopefully this is the right time.

2024 is the year of a possible Bitcoin ETF, and where MiCa will be implemented in the EU.

Investors worldwide are counting on it to be a year of greater regulatory clarity, renewing the enthusiasm of institutional investors to join the crypto arena again.

This will go hand in hand with broader regulatory acceptance from the SEC.

MICA

Stablecoin act

ETF approval

Heavy regulatory burdens on DeFi

This is only the first battle, of a very long war.

Regulation also has to be contextualized within the broader Privacy vs Compliance debate, where a strong need for neutral solutions and clearly defined regulations on DAOs and other decentralized actors emerges.

Currently, rulings are quite harsh concerning it (Ooki DAO).

While many refuse to comply with regulations, appealing to their libertarian values, we agree with Ryan from Messari that the regulatory battle is fundamental to ensure that the enforced policies allow crypto to flourish according to its ethos and value, without curbing its wings within Orwellian government oversight.

4️⃣ What Goes Around Comes Back Around: in Perpetual Motion

One of the hot 2023 narratives has been Perpetual Protocols.

From GMX, Gains, Aevo, and Vertex, perpetuals have gained traction and are one of the crypto products with the best product market fit.

Timed perfectly with regulatory challenges for Centralized Exchanges, perpetuals have managed to capture a critical mass of users successfully.

However, the perpetual market has grown saturated, with a multitude of new players emerging daily, Hyperliquid, Vertex, etc. - albeit with more innovate and custom design architecture than GMX forks of old.

As such, the narrative has suffered from the lack of novelty as well as the need to further differentiate between them.

Is the perpetual Meta over?

Or will it come back in 2024?

Sometimes valid products leave room for more heated narratives.

There are a lot of new kids on the block, with cool acronyms!

2024 is the year when many Gaming solutions which started to deploy in 2021 will finally be ready for market test (maybe eheh).

Up until now, Gaming has been a laggard compared to other sectors, given the absence of a blockbuster game capturing the overall attention of the sector since AxieInfinity.

We envision the next wave to be about gaming protocols that can blur the boundaries between Web2 gaming and Web3, attracting both crypto degens and normal gamers, such as Immutable, XAI Games, and WINR as standalone chains.

Within this context, the same applies to SocialFi.

Once hailed as the new paradigm change, @friendtech's initial hype has been fading in the past few months.

While we are sure that it will return once we get closer to the airdrop, it still shows how hard it is to establish a SocialFi app with long-term traction in crypto.

Will new dApps manage to change our habits?

DePin: Helium, AltheaNetwork

DeSci: ResearchHub, DeSciWorld

Gaming: Immutable, Beam

SocialFi: Friendtech, LensProtocol, Farcaster

6️⃣ How to Launch a Project? The Blur Model & Point-Based Systems

Point-based systems have proved to be the most preferred (and arguably most successful) way to raise funds before launching a network, this is the case for Friend Tech, and Blur, among others.

The most recent example of a launch integrating a point system for a potential airdrop is Blast, a new L2 that in under a month has accumulated over 850m in TVL.

Turns out, investors are not that afraid to commit to locking their stack for further rewards.

However, as the market heats up again, opportunity costs might rise: will a point system function well in a bull market? what will be the new trend?

Is there a right way to build?

7️⃣ Battle of the Builders

When it comes to building protocol, there’s no special sauce.

Each and every approach depends on a multitude of factors.

As a consequence, protocols might decide whether they want to build their own chain to fully customize it to their needs, or deploy within a collaborative ecosystem.

Collaborative ecosystem (Arbitrum derivatives):

GMX, Gains, Dolomite, Mux Protocol, Dopex, Vertex, and Rysk

App chains/niche chains:

Aevo, Lyrafinance, and HyperliquidX

8️⃣ The Evolution of Governance

As an active participant in Arbitrum governance, Castle recognizes the importance of building the appropriate infrastructure in place to ensure the smooth functioning of the system, reflecting the core values behind every network.

We envision 2024 to be a year where on-chain Governance reclaims its spot as one of the most important and often underestimated use cases of crypto, as well as drivers of innovation.

DAOs implementing decentralized governance are walking on a new path. As a consequence, there are no best practices when it comes to moving forward: most DAOs go through trial and error iterations as their baptism of fire.

Much can be learned from initial iterations of OG DAOs such as MakerDAO Aave and Synthetix within the context of specific governance applications.

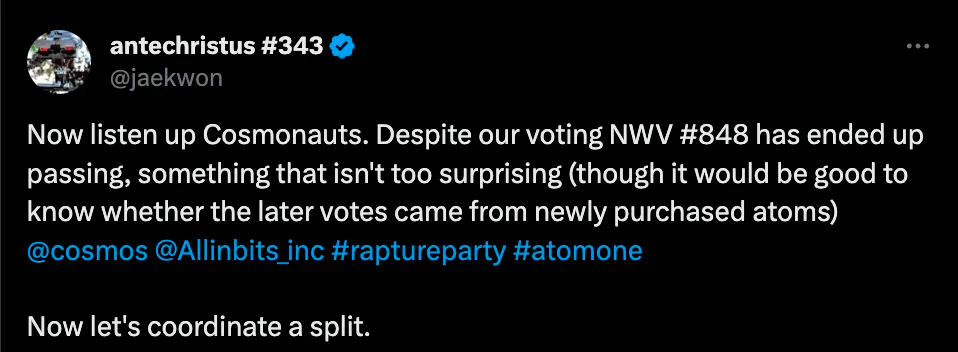

We are told that governance also means accepting when decisions are taken that might be contrary to what you hoped for... Does it?

Apparently not always, as recently shown by Cosmos.

9️⃣ Investor Framework: Bull vs Bear

How should investors change their frameworks depending on the market conditions?

Bear: fundamental/sound approach = real yield and revenue-generating focus

Bull: growth potential takes precedent = predicting future possible valuations

🔟 AI + Blockchain

With advances in AI, machine learning, and general computing power coming on leaps and bounds, it is no wonder we are finding ways to plug this technology into a blockchain.

These applications can take on many forms, across decentralizing computation, monetizing decentralized AI services, powering off-chain autonomous agents, and even trying to revolutionize and implement a decentralized computer chain (including Autonolas, Bittensor, Fetch Ai, and TauLogicAI).

We have already had a teaser of this, with projects such as $OLAS, $TAO, $RNDR, and $AGRS, reaching important valuations.

This is only the beginning as 2024 will finally deliver some of these products where we'll be able to see the potential of crypto + AI.

Gamechanger or fluff?

That's it for our 2024 Narrative Teaser list!

Stay tuned as we'll be publishing a more comprehensive report during the first week of January.

Wish everyone happy holidays 🥳

The Alpha Assembly

Receive Telegram notifications of our posts and those of our partners! Join the Alpha Assembly Telegram channel today!

The central hub for anything crypto:

High-level on-chain capital movements

Web3 gaming insights

DeFi research and strategies to give you an edge

Covering everything NFT related: collections, tools ,NFT-fi, you name it

News, alpha, and on-the-pulse-content

Thanks for reading, please give us a follow on Twitter at @Castle__Cap and visit our website to learn more about our services.

Virtually yours,

The Castle

In our newsletter, we may discuss projects or tokens in which we hold positions. While we aim to provide informative content, our views are not financial advice. Please conduct your research and consult professionals before making investment decisions. Crypto markets are volatile, and past performance doesn't guarantee future results. Invest responsibly, and be aware of the risks. Your capital is at risk, and we do not accept liability for any losses.

Reply